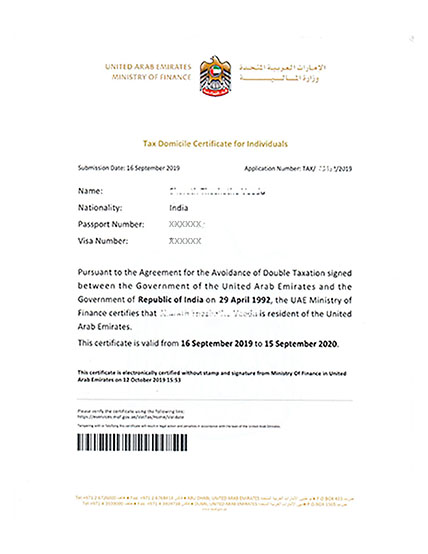

Tax Residency Certificate in UAE

Tax Residency Certificate or sometimes called as Tax Domicile Certificate is an official certificate or document which is issued by Ministry of Finance of UAE to either Companies inside UAE for at least 1 year of age or Individual with UAE residency visa / permanently residing in the UAE for at least minimum of 180 Days.

This Official Certificate is used to fully utilize the advantages of the extensive double tax treaties and to take advantage of double taxation avoidance agreements signed by the UAE with over 76 Countries in the World and this certificate valid for one year from the date of its issue.

This Official Tax Residency Certificate in UAE is not Applicable to Offshore Companies (International Business Companies).

The Required Documents for Tax Residency Certificate will depend on the type of Applications: -

Required Documents for Tax Residency Certificate (Companies):

For Companies operating in the region and have completed more than one year of business operations, following documents are required for applying the tax Residency Certificate in UAE.

- Valid Company Trade License Copy

- Establishment contract certified by official authorities (if it is not a Sole Company).

- Shareholders & Manager Passport Copy

- Shareholders & Manager Residence Visa

- Shareholders & Manager Emirates ID

- Certified copy of the latest audited financial Statement/Audit Report

- Latest and validated 6-month Company bank statement

- Certified copy of Company lease agreement or Tenancy Contract

- Tax forms (if any) from the country in which the certificate is to be submitted.

Required Documents for Tax Residency Certificate (Individuals):

For Individuals, following documents are required for applying the tax Residency Certificate in UAE.

- Passport Copy

- UAE Residence Visa Copy

- Emirates ID Copy

- A certified copy of (residential) lease agreement or Tenancy Contract Copy

- Latest Salary certificate.

- Latest & validated 6-month bank statement

- A report from the General Directorate of Residency and Foreigners Affairs specifying the number of days the resident has stayed in the UAE.

- Tax forms (if any) from the country in which the certificate is to be submitted.

Who is eligible for the UAE Tax Residency Certificate?

For the eligibility for UAE Tax Residence Certificate, the applicants can be categorized into two - Natural Persons and Legal Persons.

Natural Person / Indivdiuals

The applicants must be UAE residents and have stayed in the country for at least 180 days in a year. Also, the individual must have a local residence proof such as a Tenancy Contract, Title Deed of property, or a freelance permit they own to show the required physical substance in UAE.

Legal Person / Corporates

The other category of applicants are the enterprises or establishments registered in UAE's business jurisdictions - Mainland and Free Zone. The companies must be at least 1 year old to apply for the Tax Residence Certificate.

Also, the company's financial accounts have to be audited and must be submitted for review along with the application form. The audit can be conducted by an accredited audit firm in the UAE if the company does not have an in-house auditor. They must certify and stamp the audit report before submitting it to the authorities.

Additionally, the company must ensure that the audited financial report must cover the year for which the Tax Residence Certificate is requested. Offshore companies are out of the Tax Residence Certificate scope as they are treated as Non-residence companies and also not listed in the Double Taxation Avoidance Agreements.

What are the revised Tax Residence Certificate rules in UAE?

As per the UAE Government's ministerial decision (No.27 of 2023), certain provisions on the Determination of Tax Residence were amended. So, now there is more clarity on the requirements for a natural person to qualify as a Tax Resident in the UAE.

As per the Cabinet Resolution No. 85, effective from 1 March 2023, individuals can be considered as Tax Residents in the UAE if they meet any one of the following conditions:

- Their principal place of residence and centre of financial and personal interests is in the UAE

- They have been physically present in UAE for 90 days or more over a consecutive 12-month period and are UAE nationals, UAE residents, or GCC nationals with either a permanent establishment or they have a job or a business in the UAE.

- The individual has been physically present in UAE for 183 days or more in a consecutive 12-month period. They need not own a permanent setup in UAE but the place of residence must be available to them when they are in UAE.

How can I get a UAE Tax Residency Certificate?

To obtain the UAE Tax Residency Certificate, the applicant must register with the Federal Tax Authority and create a profile. AURION will guide you throughout the process of obtaining a UAE Tax Residency Certificate for you and your company at the earliest.

Following are the steps involved in obtaining the UAE Tax Residence Certificate.

- Signup with the Federal Tax Authority to create an Account to Register for the Tax Residency Certificate in UAE

- Navigate to the Personal Account Dashboard

- Create a Tax Residency Certificate by clicking on the option

- Choose the right selection - Natural Person or Legal Person

- Upload all the relevant documents and fill up the fields

- Click on the Finish button to complete the setup process

- Make the Fee Payment to obtain the Tax Residence Certificate online

- If a Federal Tax Authority (FTA) Attestation is needed for a Tax Form, the complete audit report and application form must be mailed to the FTA by the applicant. (For Certain Cases)

The applicants especially 'Natural Persons' must consider their physical presence in the UAE while applying for the Tax Residence Certificate. Their arrival and departure to and from the UAE must be timed accordingly.

What are the benefits of a Tax Residence Certificate in UAE?

UAE is an attractive destination for doing business due to its very low taxation rates. The VAT is at 5% and Corporate Tax at 9% making it one of the lowest rates of taxation when compared to other parts of the world.

Also, the UAE have the Double Taxation Avoidance Agreement Treaty (DTAA) signed with 137 countries including Canada, Germany, the UK, India, and more. Hence business investors and individuals from these countries residing in the UAE can apply for a Tax Residence Certificate and claim the benefits of DTAA in their home country.

For companies and individuals operating in high tax-paying countries, moving their base to UAE and setting up a company and business operations in the region would help in efficient tax planning and leveraging the benefits of DTAA significantly.

Also, the variety of tax incentives and absence of personal income tax in UAE with its exceptional business infrastructure makes the UAE a perfect choice for business establishments to flourish and expand seamlessly. One additional advantage is that individuals and companies can obtain separate tax residence Certificates that will help individuals keep their income covered at both levels.

The low taxation coupled with other business incentives such as low or no customs duty, low VAT rates, exceptional logistics support, ease of doing business, etc., makes UAE a first choice for most businesses and individuals to settle down and work.

What is the period to obtain the Tax Residence Certificate in UAE?

It takes almost 3-4 business days for the Federal Tax Authority to review the application for a Tax Residence Certificate to the applicant. So, within a Week, the digital copy of the Tax Residence Certificate will be made available to the Applicant.